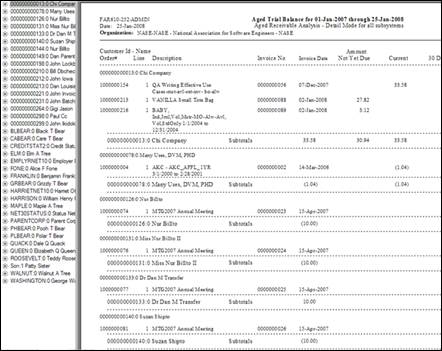

This batch report produces either a detailed or a summary aged receivables report to provide information on customer balances. Usually, balances fall into several groups (i.e., current through 30 days, 30-60 days overdue, 60-90 days overdue, 90-120 days overdue, and more than 120 days overdue). It also produces customer statements. The application is specific to a single subsystem or multiple subsystems and includes/excludes unapplied credits. Also, you can control and change the number of days within each grouping at any time.

FAR610 will show the accumulated effect of transactions processed on AR and PPL accounts, by module. This is very important for receivable collections. It can be run only for customers who have balances over a specified period.

This report is not normally run for a single account. It can however be run for a unique PPL and AR pair (given the proper select criteria). The user can then verify that Personify AR balances tie to the GL account balance for the account pair. If FAR610 is run for a single AR account without the associated PPL account, it could yield some unexpected results.

Running FAR610 when you have scheduled payments:

If you are using FAR610 for collection purposes and, therefore, do not want to see scheduled payments until the due date, set the Exclude Deferred Payments parameter to "N". When you are comparing the aged receivables to your GL (or to FAR505 or FAR504) and using it for reconciliation purposes, set the Exclude Deferred Payments parameter to "Y". This will show the entire amount in AR regardless of the due date. For example, you have an active order line with $120 due, nothing paid and 4 scheduled payments, of $30 each, on 1/1, 4/1, 7/1 and 10/1. If you run FAR610 with an end date of 1/31 and the Exclude deferred payments parameter set to N, it will show $30. If you run FAR610 with an end date of 1/31/2005 and the Exclude deferred payments parameter set to Y, it will show $120. Also, $120 will have hit the AR account.

![]() This report will

include the records where current order balance is zero but have any future

balance even if the “Print Order with Zero Balance” parameter is set to

“N”. This also will be the case for the “Print Customer with 0 Balance”

parameter.

This report will

include the records where current order balance is zero but have any future

balance even if the “Print Order with Zero Balance” parameter is set to

“N”. This also will be the case for the “Print Customer with 0 Balance”

parameter.

Additional parameters were added in the 7.2.1 release to accommodate Address Change Service functionality. Please see Address Change Service for more information.

| Parameter | Description | Required? |

|---|---|---|

| Report Title | Optional parameter that allows the user to specify a report title that will print as part of the report header. | N |

| Run Mode | · CUSTOMER – prints all customers. · DETAIL – provides a detailed listing of all customers with their orders. · ORDER – provides a listing of all orders. · SUMMARY – provides a summary listing. This parameter defaults to DETAIL. |

Y |

| Organization | Defaults to the ORG_ID of the logged in user and cannot be changed. | Read-only |

| Organization Unit | Defaults to the ORG_UNIT_ID of the logged in user and cannot be changed. | Read-only |

| FAR610_Mode | · Aged Receivables Report (FAR610) – one text file will be generated. · Aging Report with Customer Statements (FAR610T) – one text file and one report will be generated. · Statement of Previous Run – Parent Job Id is required in order to run it successfully in this mode. |

Y |

| Begin Date | All transactions having txn_date >= this date will be selected. | Y |

| End Date | All transactions having txn_date <= this date will be selected. | Y |

| Generate Data | This parameter decides whether or not to save records in FAR610_Master and FAR610_Detail tables. | Y |

| Purge Data | This parameter decides whether or not to purge data from FAR610_Master and FAR610_Detail tables after generating the report. | N |

| Subsystems | Select one or more subsystems for which to run the report. If left blank, the process will run for all subsystems. Report can be run for multiple subsystems at a time. | N |

| Aging Interval #1 | Y | |

| Aging Interval #2 | This parameter should be greater than the Aging Interval #1. | Y |

| Aging Interval #3 | This parameter should be greater than the Aging Interval #2. | Y |

| Aging Interval #4 | This parameter should be greater than the Aging Interval #3. | Y |

| Display All Buckets | This parameter determines whether or not to display values for all buckets in the report. | Y |

| Youngest Interval | Enter zero (0) to select all intervals. Enter 1 – 4 to select transactions equal to and older than the value entered on the corresponding Interval number. | Y |

| Include Receipts Refunds | This parameter determines whether or not to include receipts and refunds before invoicing. | Y |

| Unapplied Credits | This parameter determines whether or not to include unapplied credits in the report. | Y |

| Customer Minimum Debit | All customers with balances greater than the amount entered in this parameter will appear on the all customers with balances report. | N |

| Customer Minimum Credit | All customers with credit balances less than the amount entered in this parameter will appear on the Aged Receivables report. Enter a large amount here to get only debit balance customers in the report (e.g., 999999999). | N |

| Print Customer with 0 Balance | Setting this to Y will include orders for customers where the customer's total balance due is zero , but there are orders with offsetting debit and credit balances. When generating statements, this should be set to N; otherwise, it's recommended that this be set to Y. | Y |

| Order Minimum Debit | All orders with balances greater than the amount entered in this parameter will appear on the report. Enter a large amount here to get only credit balance orders in the report (e.g., 999999999). | N |

| Order Minimum Credit | All orders with credit balances less than the amount entered in this parameter will appear on the report. Enter a large amount here to get only credit balance orders in the report (e.g., 999999999). | N |

| Print Order with Zero Balance | Setting this to Y will include orders where the order's total balance due is zero, but there are order lines with offsetting debit and credit balances. When generating statements, this should be set to N; otherwise, it's recommended that this be set to Y. | Y |

| Minimum Debit for Order Line | All order lines with balances greater than the amount entered in this parameter will appear on the report. Enter a large amount here to get only credit balance order lines in the report (e.g., 999999999). | Y |

| Minimum Credit for Order Line | All order lines with credit balances less than the amount entered in this parameter will appear on the report. Enter a large amount here to get only credit balance order lines in the report (e.g., 999999999). | Y |

| SubTitle | Optional parameter that allows the user to specify a report subtitle that will print as part of the report header. | N |

| Company Number | Enter company number for which you want to run this report. Leaving it blank would run aging for all the companies. | N |

| Aging Method | · INVOICE_DATE – calculates the aging bucket based on Invoice Date. This will ignore payment schedules. · DUE_DATE – calculates based on due date. This will considered payment schedules. |

Y |

Specific Message for Bucket 1, Specific Message for Bucket 2, Specific Message for Bucket 3, Specific Message for Bucket 4, Specific Message for Bucket 5 |

Any specific message for the bucket can be specified. | N |

| General Message | Any general message for customers. | N |

| Customer Statement Mode | To view the customer statement:

|

N |

| Generate Exception Report | This parameter determines whether or not to generate the exception report. | Y |

| Association Name | The name of the association. | N |

| Association Address Line 1, Association Address Line 2, Association Address Line 3, Association Address Line 4, Association City, Association State, Association Postal Code, Association, Country Code, Association Phone Number, Association Fax Number, Association Email Address | The address and communication details for the association. | N |

| Pay Label Name, Payment Address 1, Payment Address 2, Payment Address 3, Payment Address 4, Pay City Name, Payment State, Payment Pay Postal Code, Payment Pay Country Code | The payment address information. | N |

| Use Address Change Service | · Y = the labels are printed with ACS Format having Intelligent Mail Barcode, and the process makes sure the appropriate values are set for the Barcode Identifier, Service Type Identifier, and Mailer ID parameters. The width of the label also increases by one row. · N = the ACS format is ignored and the label is printed without the barcode. |

N |

| Barcode Identifier | A two-digit value that indicates the degree of pre-sorting this mail piece received before being presented for mail delivery. | N |

| Service Type Identifier | A three-digit value representing both the class of the mail (such as first-class, standard mail, or periodical), and any services requested by the sender. | N |

Mailer ID |

A six or nine-digit number assigned by the USPS that identifies the specific business sending the mailing. Higher volume mailers are eligible to receive six-digit Mailer IDs, which have a larger range of sequence numbers associated with them; lower volume mailers will receive nine-digit Mailer IDs. To make it possible to distinguish six-digit IDs from nine-digit IDs, all six-digit IDs begin with a digit between 0 and 8, inclusive, while all nine-digit IDs begin with the digit 9. |