Defining Meeting/Session Product Revenue Accounts

This task defines the income and deferred revenue accounts

used in sales and receipt transactions. Revenue can be distributed across

multiple accounts or companies by percentage of the sales amount. Where

multi-company transactions exist, Personify will create inter-company

transactions for the revenue distribution.

Details

associated with this task should not be defined without input from the

Accounting/Finance department.

Details

associated with this task should not be defined without input from the

Accounting/Finance department.

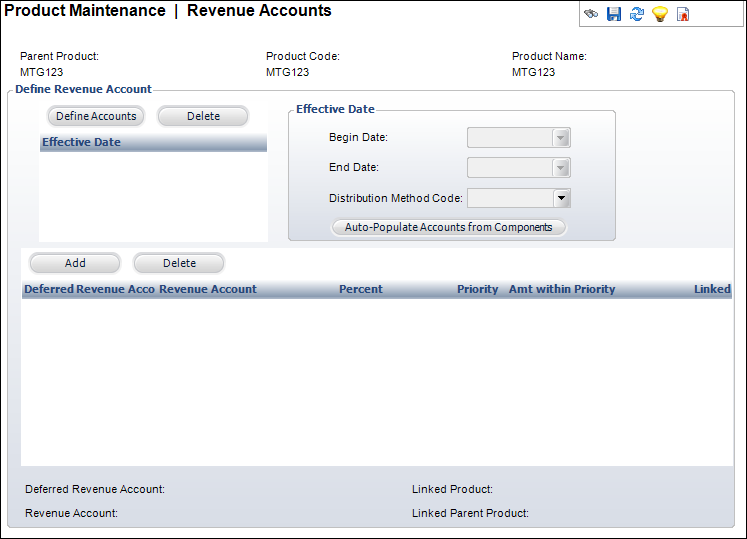

To define Revenue accounts:

1. Click

Define Revenue Accounts from the

Define the Product task category.

The Revenue Accounts screen displays, as shown below.

2. Click

Define Accounts.

As of 7.4.2, the Account Chooser screen automatically displays because

a revenue account detail record is required in order to save the revenue

account master record.

3. Select

the appropriate revenue account.

Please see Defining

Revenue Account Pairs for more information on revenue accounts and

their functionality.

Please see Defining

Revenue Account Pairs for more information on revenue accounts and

their functionality.

4. The

Begin Date defaults to today's

date. Change this date if necessary.

5. If

necessary, select the End Date

from the drop-down.

6. Select

the Distribution Method Code from

the drop-down.

7. From

the table below, enter the following in the appropriate table cell:

· Percent of the revenue that should

go into this account

· Priority number of the revenue account

· Amt within Priority

8. Click

Save.

| Screen Element |

Description |

Define Revenue Account |

| Define Accounts |

Button. When clicked, an Effective Date row is added to the

table and a Revenue account is added to the product. |

| Add |

Button. When clicked, a row is added to the Deferred Revenue

Account table. The Account Chooser opens to search for a Deferred

Revenue account. |

| Delete |

Button. When clicked, the highlighted row from the table and

the information entered in the row are deleted. |

| Deferred Account |

Table column. This field is the account that is used for sales

transactions. If no deferred revenue is to be recorded, this should

be a standard revenue account. It is validated against the FGL_Account_Master

table and must be valid for your organization. A warning message

displays if an account is selected that is not for the organization

unit of the product. It may be a liability or revenue account. |

| Revenue Account |

Table column. This field is the offsetting income account.

This is the account that will be used by a revenue recognition

process. It is validated against the FGL_Account_Master table.

However, a warning message will display if an account is selected

that is not for the organization unit of the product. It must

be a revenue account. |

| Percent |

Table column. This field is the percentage of the revenue that

should go to this account. The total percentages of all line items

must equal 100 for the record to be saved (format 000.0000). |

| Priority |

Table column. This field is only enabled when the Distribution

Method is “Priority.” When discounts or other pricing situations

result in a line item not receiving its full amount, the first

priority item will receive its full amount and then the next priority

item in sequence. |

| Amt within Priority |

Table column. This field is only enabled when the Distribution

Method is “Priority.” When populated and when the amount to be

distributed (because of discounts or other pricing) falls lower

that the amount specified with this line item, the amounts will

be filled based on this priority. |

| Linked |

Table column. Select when the product's Revenue Distribution

Product code is not null. Indicates that the line is associated

with a specific component product. |

Effective Date |

| Begin Date |

Drop-down. This field indicates the date on which this distribution

will begin to be used as compared to the order date.

Once an order has been placed

for this product, using the selected revenue account, the Begin

Date cannot be edited. Once an order has been placed

for this product, using the selected revenue account, the Begin

Date cannot be edited.

Each time a change is made to the distribution accounts, a new

start date must be defined for this distribution so that a history

and an audit trail can be maintained. This date defaults to the

“Available From” date from the General Product Setup screen. |

| End Date |

Drop-down. The end date for the Revenue account. |

| Distribution Method Code |

Drop-down. The value selected in this field automatically

updates all detail records for this effective date. Valid values

include:

Percentage – Will distribute by

percentage of the price only. The Priority and Amount within

Priority columns are disabled. The total amount of the percentage

must equal 100. Priority – Enables the Priority

and Amount within Priority columns. When discounts or other

pricing situations result in a line item not receiving its

full amount, the first priority item will receive its full

amount and then the next priority item in sequence. If no

amount is specified, the system will distribute the remaining

amount by percentage. |

| Auto-Populate Accounts from Components |

Button. When clicked, the revenue account pairs set for the

component products are automatically added to the product’s revenue

accounts. Since components are free and do not have specific accounts

associated with them, the account associated with the component

product displays. For this button to work, components must be

defined for the product. |

|

Details

associated with this task should not be defined without input from the

Accounting/Finance department.

Details

associated with this task should not be defined without input from the

Accounting/Finance department. Details

associated with this task should not be defined without input from the

Accounting/Finance department.

Details

associated with this task should not be defined without input from the

Accounting/Finance department.

Please see Defining

Revenue Account Pairs for more information on revenue accounts and

their functionality.

Please see Defining

Revenue Account Pairs for more information on revenue accounts and

their functionality.