Details

associated with this task should not be defined without input from the

Accounting/Finance department.

Details

associated with this task should not be defined without input from the

Accounting/Finance department.

This task is used to define receivable, pre-payment liability, write-off, cancellation, and discount transactions, as well as the pay priority of a given product within an order. Also, this task defines tax categories (e.g. US, GST, and VAT).

Details

associated with this task should not be defined without input from the

Accounting/Finance department.

Details

associated with this task should not be defined without input from the

Accounting/Finance department.

Once

an order line exists for this product with the same effective date as

the one setup here, with Line Status not equal to 'C', then the GL accounts

for that effective date cannot be changed for this product.

Once

an order line exists for this product with the same effective date as

the one setup here, with Line Status not equal to 'C', then the GL accounts

for that effective date cannot be changed for this product.

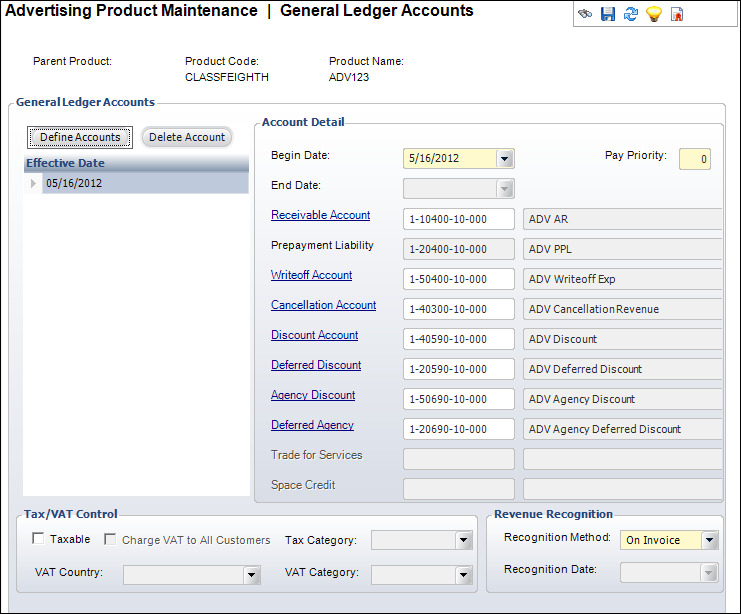

To define the General Ledger accounts:

1. From

the Define the Product task category, click Define

GL Accounts.

The General Ledger Accounts screen displays, as shown below.

2. Select the Begin Date from the drop-down.

3. Enter the Pay Priority.

4. Click

the Receivable Account link

to search for a receivable account.

The Prepayment Liability account populates automatically based on the AR-PPL

account pair set up in System Setup.

5. Click the Writeoff Account link to search for a write-off account.

6. Click the Cancellation Account link to search for a cancellation account.

7. Click the Discount Account link to search for a discount account.

8. Click the Deferred Discount link to search for a deferred discount.

9. Click the Agency Discount link to search for an agency discount.

10. Click the Deferred Agency link to search for a deferred agency.

11. If the product uses sales tax, perform the following:

a. From the Tax/VAT Control, select the Taxable checkbox.

b. Select the Tax Category from the drop-down.

12. If the product uses VAT tax, perform the following:

a. From the Tax/VAT Control, select the Taxable checkbox.

b. Select the VAT Category from the drop-down.

13. If the product uses both VAT and sales tax, perform the following:

a. From the Tax/VAT Control, select the Taxable checkbox.

b. Select the Tax Category from the drop-down.

c. Select the VAT Category from the drop-down.

14. If the product uses VAT tax for every customer purchasing the product, regardless of the ship-to address, from an EU (European Union) country, perform the following:

a. From the Tax/VAT Control, select the Charge VAT to All Customer checkbox.

b. Select the VAT Country from the drop-down.

c. Select the VAT Category from the drop-down.

15. In the Revenue Recognition section, select the Recognition Method from the drop-down.

16. Select the Recognition Date from the drop-down. Note that this field will be disabled unless “On Specific Date” is chosen from the Recognition Method drop-down.

17. Click Save.

Screen Element |

Description |

|---|---|

General Ledger Accounts |

|

| Define Accounts | Button. When clicked, an Effective Date row is added to the table and another set of General Ledger accounts are added to the product. |

| Effective Date | Table row. Represents a General Ledger account associated with the product. The date listed is correlated with the Begin Date value. |

| Delete Account | Button. When clicked, the highlighted row and the General Ledger account is deleted from the product. |

Account Detail |

|

| Begin Date | Drop-down. The start date for the General Ledger account. The Begin Date of the first set of GL Accounts defined defaults to the “Available From” date from the General Product Setup screen. The Begin Date of each additional set added after the first defaults to today’s date. |

| End Date | Read-only. The end date is automatically populated to one day before the next Begin Date of the next set of GL accounts. |

| Pay Priority | Text box. Establishes the order by which line items on a multi-product order are paid. Associations that discount inventoried prices on items may assign products a preferred priority to ensure the inventory line item is paid prior to line items from other subsystems. The lowest priority number is paid first, with zero being paid before any other. |

| Receivable Account | Link. When clicked, you can search for the appropriate AR and prepayment account pairs, as defined on the Organization Unit Maintenance screen (see Defining AR and Prepayment Account Pairs). |

| Prepayment Liability | Read-only. Defaults based on the receivable account identified above. This is the account that is used to store payments prior to invoicing. |

| Writeoff Account | Link. When clicked, you can search for the appropriate write-off account. When a write-off of an open balance (including tolerance write-offs) is created, the transaction is DR Write-off Account, CR Accounts Receivable. The account must be either an income or expense account. |

| Cancellation Account | Link. When clicked, you can search for the appropriate cancellation account. When cancellation fees are charged, this account is used. It is typically an unearned income account, though it may also be defined as an expense account. |

| Discount Account | Link. When clicked, you can search for the appropriate discount account. When a discount is granted for this product, this account number is used. It reduces the AR number while maintaining the full revenue account amount. It may be either a revenue or expense account. |

| Deferred Discount | Link. When clicked, you can search for the appropriate deferred discount account. When a deferred revenue transaction is created, this account is used. If no deferred transactions are expected, this account should be the same as the discount account. |

| Agency Discount | Link. When clicked, you can search for the appropriate agency discount account. When a discount is granted to the agency for this product, this account number is used. It reduces the AR number while maintaining the full revenue account amount. It may be either a revenue or expense account. |

| Deferred Agency | Link. When clicked, you can search for the appropriate deferred agency account. When a deferred revenue transaction is created for an agency, this account is used. If no deferred transactions are expected, this account should be the same as the agency discount account. |

Tax/VAT Control |

|

| Taxable | Checkbox. When checked, indicates the product is taxable for sales tax. If this is checked and the product uses sales tax, select the Tax Category. If this is checked and the product uses VAT tax, select the VAT Category. If this is checked and VAT tax should be charged for all customer regardless of ship-to address, select the Charge VAT to All Customer checkbox and select VAT Country and VAT Category. |

| Charge VAT to All Customers | Checkbox. When checked, indicates the product is taxable for value-added tax. This checkbox is only enabled if the Taxable checkbox is selected. If this is checked, select the VAT Country and VAT Category. |

| Tax Category | Drop-down. Further defines how taxes will be calculated. This

checkbox is only enabled if the Tax/VAT

Control drop-down on the Organization Unit Maintenance screen

is set to B or N and if the Taxable checkbox is selected.

|

| VAT Country | Drop-down. The country in which the value-added tax will be used for this product. This checkbox is only enabled if the Tax/VAT Control drop-down on the Organization Unit Maintenance screen is set to B or Y and if the Taxable checkbox is selected. |

| VAT Category | Drop-down. Indicates which type of value-added tax is charged

for this product.

The values are populated based on the non-fixed VAT_CATEGORY system type for the ORD subsystem. |

Revenue Recognition |

|

| Recognition Method | Drop-down. Controls how revenue recognition for the order will

be handled. Options include:

The values are populated based on the fixed REVENUE_RECOG_METHOD system type for the ADV subsystem. |

| Recognition Date | Drop-down. Enabled when Recognition Method value is “On Specific Date.” Indicates the specific date that revenue should be recognized. After this date, sales transactions will hit the real revenue account rather than the deferred revenue account. |