Creating an Advanced Adjustment

An adjustment transaction adjusts the revenue accounts

for an order. This differs from a write-off which is specifically

a transaction that changes a balance in Accounts Receivable for an order

line item and records that change against a write-off account.

Adjustments are only made to the sales side of a transaction so typically

affect the receivable account versus the revenue accounts and possibly

the discount accounts.

Adjustments transactions are actually created only for invoiced line

items. If an adjustment is made to an uninvoiced line item,

i.e. there is no active sales transaction and just a proforma sales transaction,

then all we do is update the proforma FAR_TXN.Base_Amount and not generate

any FAR_Txn_Detail records for any distribution.

Transaction Structure

When the

receivable balance increases:

DR Accounts

Receivable

CR (Deferred) Revenue Accounts

When

the receivable balance decreases:

DR (Deferred)

Revenue Accounts

CR Accounts Receivable Accounts

Discount accounts may also play into this scenario.

The

sign of the adjustment in Far_Txn.Base_Amount indicates whether the AR

(the amount owed) is increased or decreased. An

adjustment with a positive sign means that you are increasing the price

of the product. An adjustment

with a negative sign, means that you are decreasing the price of the product.

The

sign of the adjustment in Far_Txn.Base_Amount indicates whether the AR

(the amount owed) is increased or decreased. An

adjustment with a positive sign means that you are increasing the price

of the product. An adjustment

with a negative sign, means that you are decreasing the price of the product.

Source of the Accounts

When the

receivable balance increases:

Debit: The

AR account is found at the order_detail level (Order_Detail.AR_Account).

Credit: Found

in Product_Revenue_Distribution for the product referenced in the order_detail

line based on the order_date versus the effective date in Product_Revenue_Distribution.

When

the receivable balance decreases:

Debit: Found

in Product_Revenue_Distribution for the product referenced in the order_detail

line based on the order_date versus the effective date in Product_Revenue_Distribution. .

Credit: The

AR account is found at the order_detail level (Order_Detail.AR_Account).

Deferred

Versus Real Revenue Accounts

If Order_Detail.Recognition_Status_Flag doesn’t = ‘C’, then the system

uses the deferred account accounts. Otherwise, the system uses

the non-deferred accounts. In this case it is deferred revenue versus

revenue.

Distribution of the Amount

It is possible to have multiple revenue or deferred revenue accounts

referenced in an adjustment transaction. The amount is then based

on the original distribution rules for the product. Rather than trying

to determine the rules within the adjustment transaction, the system simply

recalculates the distribution based on the revised product price, i.e.

the price less the adjustment, use the central distribution routine, compare

it to what was already distributed, and record a transaction for the differences.

Special Situations with Adjustments

Adjustments to Uninvoiced Orders

Users often want to adjust the price of line items within orders and

to record the reason for the adjustment. This is easy to do for invoiced

transactions since the system simply creates a standard type=6 transaction. For

proforma or uninvoiced orders, the system uses a transaction type that

is simply a memo transaction (txn_type=’8’). The reason for the adjustment

will be maintained in the FAR_TXN.COMMENTS in the memo transaction. Memo

transactions must be ignored in all calculations of balances though the

amount of the adjustment should be maintained in the amount column. When

the order is invoiced, the adjustment column in order_detail will be factored

into the transaction against the revenue accounts.

If the order is uninvoiced, the system automatically creates a Memo

(type=8) transaction rather than a type=6.

Space Credits and Trades for Services

These are special adjustment transactions in that they do not affect

the revenue accounts but rather affect a special space credit or trades

account

The account for space credits is stored in the product_account table.

It is an expense or contra-revenue account that offsets accounts receivable.

The structure of this is the same thing as a standard adjustment transaction:

DR Space-Credit

CR AR

The debit account comes from Product_Account.space_credit_account or

Product_Account.Trade_for_Services_Account.

Users will be able to define space credits against a specific show with

the option of creating a financial adjustment to that same show. If no

financial adjustment is created for the current show that credit can later

be transferred to a future show once that order has been created at which

time the user will be able to move the credit and create a financial transaction

at that time.

Minimum information needed for the process:

· Order

Number and Line Number

· Adjustment

Reason

· Amount

of Adjustment (Positive increases the price; negative decreases

the price.)

· Type

(Optional: Adjust (default), Space Credit, Trade)

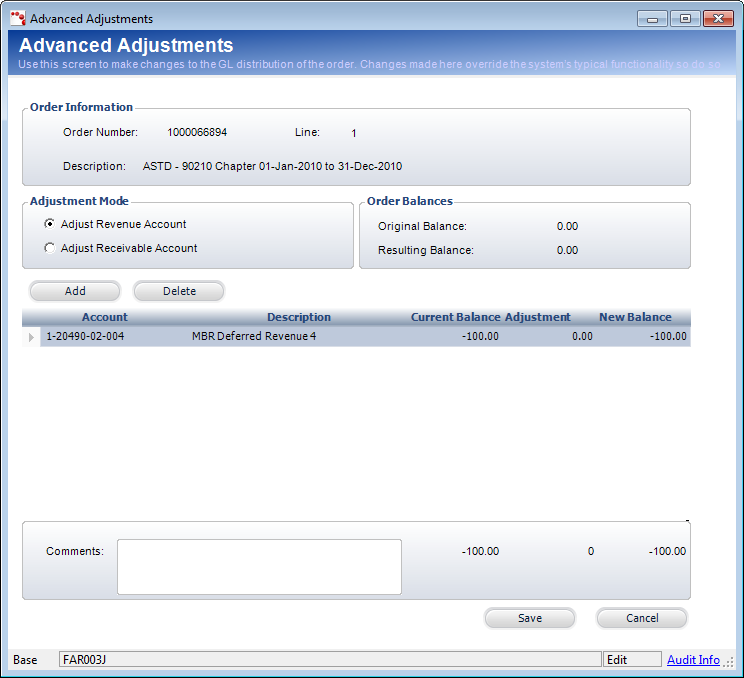

On the Advanced Adjustments screen, you can define advanced criteria

for an order line item price adjustment, such as selecting to adjust a

specific revenue or receivable account. A Journal Entry (Type J) transaction

is created for adjustments to the revenue account. A Write-Off (Type 5)

transaction is created for adjustments to the receivable account.

This functionality

should only used by the Finance department. TMA Resources recommends you

set up security for this screen.

This functionality

should only used by the Finance department. TMA Resources recommends you

set up security for this screen.

The advanced adjustments functionality is used if you accidentally charge

to the wrong revenue account or to refund a cancellation fee. To refund

a cancellation fee, debit the cancellation account and reverse the debit/credit

memo (adjust receivable account). If revenue recognition is “On Invoice,”

you can change the revenue account.

If revenue can

still be recognized (the order is active and not cancelled), then you

cannot perform a revenue adjustment.

If revenue can

still be recognized (the order is active and not cancelled), then you

cannot perform a revenue adjustment.

Advanced adjustments are only needed on cancelled orders because if

the order is active, you have more options without using this screen (such

as writing off a balance or adjusting a price). Only perform an advanced

adjustment when the order has a $0 balance for Accounts Receivable (AR).

To

create an advanced adjustment:

1. On

the Customer Financial Analysis

screen, select the appropriate line item from the Order and Transaction

Analysis tab and click the Advanced Adjustment button.

The Advanced Adjustments screen displays, as shown below.

2. Select

the appropriate Adjustment Mode radio button:

· Adjust

Revenue Account – If an adjustment is made to this account, Journal Entries

for transaction type and registration revenue are created. The credit

amount must equal the debit amount for a revenue account adjustment.

· Adjust Receivable Account – If an adjustment

is made to this account, a write-off transaction type and a Journal Entry

for the registration revenue are created.

3. Click

Add. A new row is added to the table.

4. Click

inside the Account table cell.

A GL Account Chooser displays.

5. Search

for and select the appropriate account.

6. Click

inside the Adjustment table cell and enter the adjustment amount.

The New Balance calculates automatically.

7. Enter

comments related to the adjustment. Comments are required for this screen.

8. Click

Save.

The

sign of the adjustment in Far_Txn.Base_Amount indicates whether the AR

(the amount owed) is increased or decreased. An

adjustment with a positive sign means that you are increasing the price

of the product. An adjustment

with a negative sign, means that you are decreasing the price of the product.

The

sign of the adjustment in Far_Txn.Base_Amount indicates whether the AR

(the amount owed) is increased or decreased. An

adjustment with a positive sign means that you are increasing the price

of the product. An adjustment

with a negative sign, means that you are decreasing the price of the product.